Giving is not just for Christmas

3rd December 2023

The joy of giving is synonymous with Christmas, but there are gifts that can have an impact long after the festive season has finished and the decorations are packed away.

Giving is at the heart of our work and every year we give around £4.5 million in grants to local charities and voluntary groups. The funding makes a huge difference to the health and happiness of people in Essex, providing vital support to a wide range of local organisations working at the grassroots of our communities.

Currently, we manage around 180 charitable funds on behalf of generous individuals, families and businesses. Many of the people and organisations who have established funds with us have all had the satisfaction of knowing that their charitable wishes will be carried out, with every safeguard in place, to ensure that their money will be given wisely and used effectively.

Some funds are established as a way of leaving a legacy and if appropriate, can be set up within someone’s lifetime, rather than after they have died. Professional advisers, including solicitors, can work with their clients to advise them on how giving through us can be tax efficient and means that their gift will support causes close to their heart, in perpetuity.

Here are two stories of people who were introduced to us by their solicitor, Fiona Ashworth, director at Thompson Smith and Puxon (TSP) Solicitors and head of their wills and estates team.

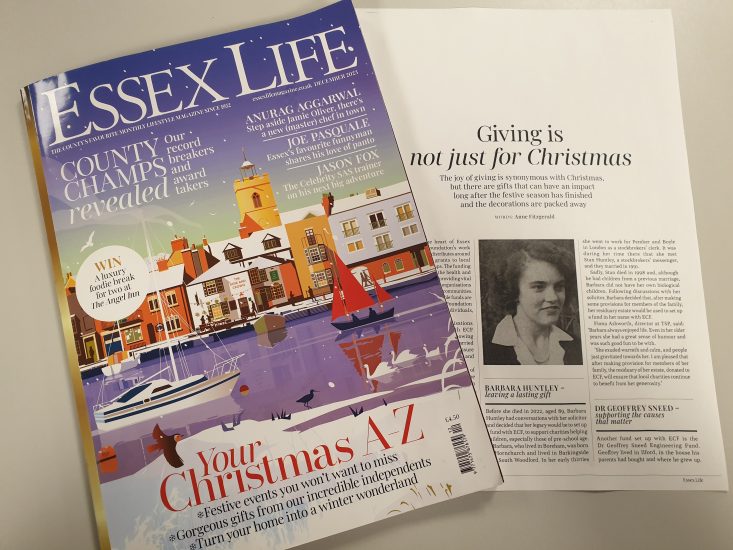

Leaving a lasting legacy

Before Barbara Huntley died in 2022, aged 89, she had conversations with her solicitor and decided that her legacy would be to set up a fund with ECF to support charities helping children, especially those of pre-school age.

Barbara, who lived in Boreham, was born in Hornchurch and lived in Barkingside and South Woodford. In her early 30s she went to work for Pember and Boyle in London as a stockbrokers’ clerk. It was during her time there that she met Stan Huntley, a stockbrokers ‘ messenger, and they married in 1991.

Sadly, Stan died in 1998 and although he had children from a previous marriage, Barbara did not have her own biological children. Following discussions with her solicitor, Barbara decided that, after making some provisions for members of the family, her residuary estate would be used to set up a fund in her name with ECF.

Fiona Ashworth said: “Barbara always enjoyed life. Even in her older years she had a great sense of humour and was such good fun to be with. She exuded warmth and calm and people just gravitated towards her. I am pleased that after making provision for members of her family, the residuary of her estate, donated to ECF, will ensure that local charities continue to benefit from her generosity.”

Supporting causes that matter to you

Another fund set up as a result of someone’s foresight before they died to help others, was a legacy left by Dr Geoffrey Sneed.

Geoffrey lived in Ilford, in the house his parents had bought and where he grew up. He was a clever student with an aptitude for maths, science and engineering. After graduating from Imperial College, London, he continued his studies with a PhD. He went on to teach physics, maths, chemistry and applied sciences at Ealing High School for 15 years and pioneered the teaching of the latter at sixth form level by helping to create the first purpose-built laboratory and unique experimental equipment installed in a state grammar school.

He was also a research director at the University of Surrey and held appointments at the Science Museum and Imperial College. In 1979 he was awarded a Churchill Fellowship by The Winston Churchill Memorial Trust and with this he travelled all over the world, studying the teaching of science.

Among Geoffrey’s notable achievements was inventing a Pulsometer which was much needed in the medical world and is still in use today. He also formed the Molecule Club, through which many schoolchildren were brought to the Mermaid Theatre in London to see a musical show covering scientific principles. The show also travelled in a caravan to schools in the Midlands.

Cars held a special place in Geoffrey’s heart and he was associated with the motor industry all his life, using his knowledge of science and engineering to write many books on motoring, its history and inventions. His pride and joy was a red 1969 Morris Oxford, which he drove off the assembly line and meticulously maintained throughout his life.

Geoffrey had no family to leave his estate to. Given his significant contribution to learning and education, it is no surprise that when his solicitor proposed the idea of setting up a charitable fund with ECF called is the Dr Geoffrey Sneed Engineering Fund to support the education of young people in the subjects that he was so passionate about, Geoffrey agreed without hesitation.

Fiona Ashworth was Geoffrey’s solicitor for many years. She said: “When talking to my clients about their estate planning, we discuss any charitable interests they may have. If it is appropriate, I am always pleased to suggest including ECF as a beneficiary. In my view, they are best placed to continue the wishes of my clients after they have died. This provides a lot of comfort for my clients, knowing they will continue to help others after their death”.

Caroline Taylor, chief executive of ECF said: “We know that most people are incredibly generous with whatever resources they have, and we are so grateful to all our fundholders and people who make donations of any amount to help others.

“As grant-makers, we could always give more, which is why we work hard to encourage people to give back to Essex.

“It can be so satisfying to take that step during your lifetime, to experience the joy of giving, rather than leaving it until it is too late. But we all know how important it is to write a will. Including ECF as a beneficiary is a meaningful way to leave a lasting legacy to support the causes that are important to you.

“A good place to start is by talking to your professional adviser, or we would be happy to talk through your ideas with you.”

- It is estimated that of the 75% of people who give to charity in their lifetime, only 7% leave a gift to charity in their will.

- By leaving 10% of your estate to charity, you will benefit from a reduction in Inheritance Tax from 40% to 36%.

Types of Legacy

- A residuary legacy: a gift made form the remainder of your estate once all other bequests to family and friends have been ade and debts paid off. This can be a percentage of the remainder, or all of it

- A pecuniary legacy: a fixed amount specified in a will

- A specific legacy: a particular item left as a gift in your will, for example, shares, property, jewellery or a painting

- A reversionary legacy: this allows the surviving partner to benefit from the estate during their lifetime and then for the balance of the estate to pass to the Foundation

If you want to make a lasting difference in Essex, we have different options that will make it easy for you. Contact Perry Norton on 01245 355947 to have a conversation.